Feasibility Analysis for Specialist Disability Accommodation (SDA) Investments

Investing in Specialist Disability Accommodation (SDA) requires careful assessment of project feasibility, financial risks, and potential returns. SDA Advisory Services provide the information and support that help determine the success of any SDA development.

The market for SDA is complex, involving varied tenancy mixes, funding arrangements, and construction costs. Without detailed analysis, investors risk misjudging these variables and facing unexpected challenges.

Feasibility analysis provides a structured approach to assess whether a project can meet financial and operational goals. It involves reviewing supply and demand data, tenancy scenarios, and cost structures.

SDA Advisory Services focus on delivering this information. They help investors understand the nuances of the SDA market and make informed decisions based on evidence rather than assumptions.

Professional advice, such as development planning support offered by Development Advisory, equips investors with data-driven insights to evaluate opportunities thoroughly.

Market Evolution and Increasing Demand for SDA Advisory Services

Investor and developer needs have changed over the last 12 months. There is a growing demand for detailed feasibility advice beyond simple house-and-land packages. More clients come seeking guidance on what to build, how to adjust existing approvals, and whether SDA development is a viable option for their land.

This change reflects how the market has evolved. Builders, investors, and developers are all asking for support to understand costs, timelines, and funding. The industry is no longer about straightforward projects but about complex decisions shaped by rising build costs and shifting demand.

Our role has expanded to provide tailored advice through in-depth feasibility work. This involves analysing supply, tenancy mixes, and financial metrics to help clients decide whether to proceed with SDA projects. This level of detail is becoming essential as the market grows more sophisticated.

Understanding Feasibility in SDA Development

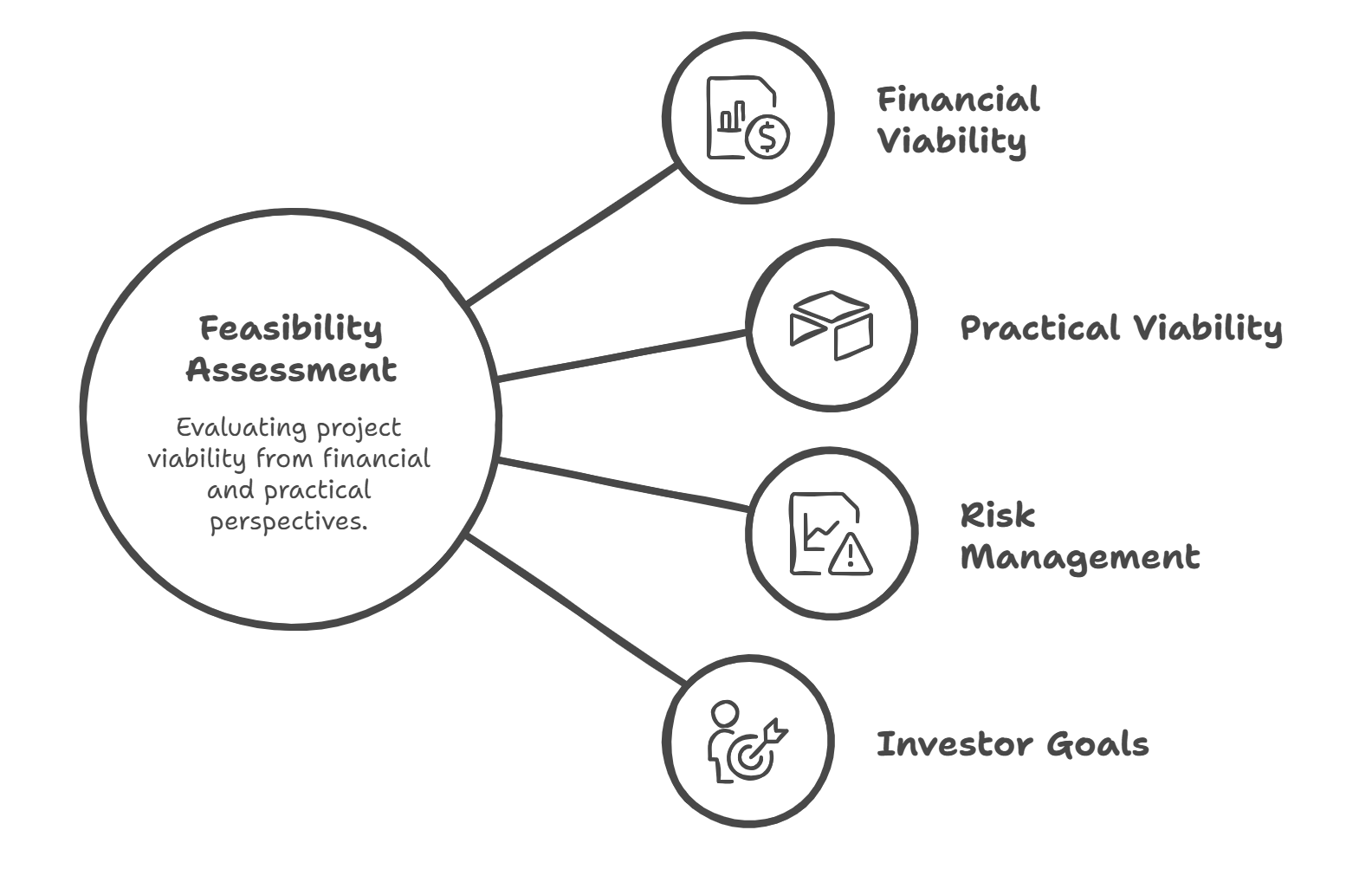

Feasibility means assessing if a project is viable from a financial and practical standpoint. It involves calculating costs, potential returns, risks, and ongoing expenses to determine if an SDA development makes sense.

This process goes beyond simple estimates. It requires detailed financial modelling and data analysis to forecast whether the investment will deliver sustainable income and cover all costs.

Feasibility considers the full picture: build costs, funding sources, tenancy scenarios, and how these interact over time. It asks whether the project will meet investor goals without unexpected losses or delays.

The goal is to provide clarity on whether the proposed development can succeed. This helps investors avoid costly mistakes and make decisions based on solid evidence rather than assumptions.

Supply and Demand Data: The Foundation of Feasibility

Before deciding to build an SDA property, it’s importo understand the local market. This involves examining how many SDA homes already exist nearby, what types they are, how many new homes are being built, and whether there are enough people who need those homes.

Information on existing SDA stock, upcoming developments, and tenant demand helps identify areas where investment is worthwhile. Building too many homes in a saturated market can lower rental returns and increase the risk of vacancies.

Accurate market data shows whether a site has good potential or if there is already an oversupply. This insight helps investors decide whether to go ahead with their plans, make changes, or consider other locations.

If there are more homes than tenants, the property may remain empty or struggle to generate enough rent. Conversely, if homes are limited compared to demand, the investment is more likely to succeed.

By analysing this data, investors can determine if their chosen location is suitable or if they should reconsider. Relying on precise supply and demand information leads to smarter decisions and reduces the risk of financial loss.

What's Tenancy Mix and How Does It Affect Your Investment Returns?

What is Tenancy Mix Analysis?

Tenancy Mix Analysis looks at how different types of tenants might live together in an SDA project and how this affects finances. Instead of just assuming a typical setup, it considers various participants with different NDIS funding levels living in houses, villas, apartments, or group homes.

The analysis considers scenarios based on sharing funding ratios, such as an individual having single tenancy funding (1:1), two participants sharing a home (1:2 funding) or three participants sharing a home (1:3 funding). It also looks at mixes that could include individuals with house funding in an apartment, or individuals with villa funding in a house, noting that this can significantly impact the potential income.

Project Design Options

SDA developments include various dwelling types such as apartments, houses, villas and duplexes. The choice depends on site size, zoning restrictions, and tenant needs. Private open space, parking, accessibility features, and building design influence both compliance and desirability.

Proper site utilisation maximises potential income while meeting regulatory standards. Each design choice impacts feasibility, so investors must consider options carefully to align with market demands.

Financial Metrics and Construction Considerations

Construction costs, project timelines, and approval processes significantly affect SDA feasibility. Build costs vary by location and design complexity. Delays in council approvals or supply chain disruptions increase holding costs and affect cash flow.

SIL (Supported Independent Living) and medium-term accommodation options can provide interim income if tenancy is delayed. Accurate financial modelling must incorporate these variables to reflect true investment performance.

What Happens If Feasibility Is Inaccurate?

The term feasibility refers to the financial metrics and calculations that determine if a proposed project or proposal is viable from a mathematical point of view. It involves looking at costs and benefits, risks, upfront costs, ongoing costs, and exit costs.

Several significant risks are associated with inadequate or incomplete feasibility work when considering SDA (Specialist Disability Accommodation) development:

- Building in the Wrong Location: Without good supply and demand data, investors might build where there’s too much supply or not enough demand. Physical issues like sloping blocks can also make certification impossible.

- Focusing Only on Cheap Land: Trying to save money by buying cheaper land to increase returns often backfires. Not fully understanding the desirability of location can lead to poor financial results.

- Underestimating Risks: SDA investment is high risk. Investors who focus only on returns without considering risks may get caught off guard. SDA is not a guaranteed success.

- Wasting Money: Without proper research and advice, investors risk spending hundreds of thousands or even millions on projects that won’t work.

- Not Vetting Partners or Data: Failing to check service providers, builders, or designers properly, or using unreliable data, can cause major problems. Hiring professionals without SDA experience is a big risk.

- Designing the Wrong Dwelling: Building a home type that doesn’t fit the area’s needs, like a four-bedroom house where another dwelling type is in demand, leads to failure. Feasibility should consider different options like villas, apartments, or duplexes.

- Wrong Tenancy Mix Assumptions: Getting the right mix of tenants is crucial. Without analysing tenant funding and possible combinations, investors can’t accurately predict income. Complex rules affect these calculations.

- Delays Cause Problems: Taking too long to act means market conditions and costs change. This makes initial plans outdated and risky, and investors may miss opportunities.

Role of SDA Advisory Services in Risk Mitigation

SDA Advisory Services supports investors and developers by providing the financial data, research, and insights needed for informed decision-making. It conducts comprehensive feasibility studies that go beyond simple house-and-land packages, assessing multi-dwelling options across various sites to ensure developments are aligned with supply and demand.

This includes offering site-specific design advice that considers different dwelling types such as houses, apartments, villas, and duplexes, rather than assuming a one-size-fits-all approach.

An important function is the detailed analysis of tenancy mixes, which uses tenant funding data and potential tenant combinations to accurately forecast net yields. SDA Advisory Services also performs thorough financial and risk assessments, evaluating all costs, returns, and benefits to determine a project's viability, while clearly communicating the complexities involved.

Risk management is another key aspect, with SDA advisory highlighting the high-risk nature of these investments and providing SWOT analyses to identify strengths, weaknesses, opportunities, and threats. The advisory process involves careful vetting of key partners—including providers, builders, and architects or designers—to ensure they have relevant SDA experience, alongside rigorous verification of data accuracy.

Finally, SDA advisory accounts for practical timelines such as council approvals, construction schedules, and material sourcing, understanding that delays can significantly affect project feasibility and increase investment risk.

Conclusion

Feasibility analysis forms the backbone of successful SDA investments. It requires detailed data evaluation, financial modelling, and market understanding to assess viability accurately.

Engaging professional SDA Advisory Services supports this process and reduces costly mistakes. Investors should seek expert guidance before committing capital to SDA developments. If you’re considering an SDA development, our team at SDA Advisory Services is here to help. Contact us today to discuss how we can assist with your project.